Investing can feel like navigating a vast and unpredictable ocean. Without a clear strategy, it’s easy to get lost in the waves of market fluctuations, emotional decisions, and unaligned goals. This is where an investment philosophy becomes invaluable. It acts as your guiding compass, helping you make consistent and rational decisions in both calm and stormy financial waters.

In this article, we’ll dive into the importance of an investment philosophy, explore the different types of philosophies, and provide a roadmap to help you develop one that aligns with your unique financial goals.

Understanding Investment Philosophy

What Is an Investment Philosophy?

An investment philosophy is a set of beliefs, principles, and strategies that guide your approach to investing. It’s the lens through which you view financial markets and decide where to allocate your resources. An investment philosophy is more than just a set of rules for buying and selling assets – it’s a deeply personal framework that reflects your beliefs, values, and financial objectives. It shapes how you approach investments, the risks you’re willing to take, and the strategies you use to grow and protect your wealth.

For instance, some investors prioritise value, seeking undervalued assets with potential for long-term growth. Others focus on growth, aiming to capitalise on companies or industries expected to expand rapidly. Whatever the approach, an investment philosophy ensures your decisions aren’t random but are instead part of a deliberate plan.

Why Is an Investment Philosophy Important?

- Consistency: It prevents impulsive, emotion-driven decisions by providing a clear framework.

- Alignment: It ensures your investments align with your financial goals, risk tolerance, and personal values.

- Focus: It helps you filter out noise and distractions in the market, focusing only on opportunities that fit your philosophy.

The Role of Personal Values and Goals in Shaping Investment Philosophy

Your investment philosophy is deeply tied to your personal values and financial goals. Are you someone who values sustainability and wants your investments to make a positive impact on the environment? ESG (Environmental, Social, and Governance) investing might resonate with you.

Similarly, your goals—whether it’s funding a comfortable retirement, buying a home, or leaving a legacy for your children—will heavily influence your philosophy. For example:

- If you’re focused on long-term stability, you might lean towards income investing.

- If you’re willing to take risks for potentially high returns, growth investing could be more appealing.

Your unique circumstances and priorities act as the foundation for shaping your investment philosophy.

Investment Philosophy vs. Investment Strategy

While an investment philosophy outlines your beliefs and approach to investing, your investment strategy is the practical plan that puts your philosophy into action. For example:

- If your philosophy emphasises low costs and market efficiency, your strategy might involve investing in index funds.

- If your philosophy centres on identifying undervalued opportunities, your strategy could include rigorous financial analysis to select individual stocks.

The philosophy is the “why,” while the strategy is the “how.” Together, they create a cohesive approach to achieving financial success.

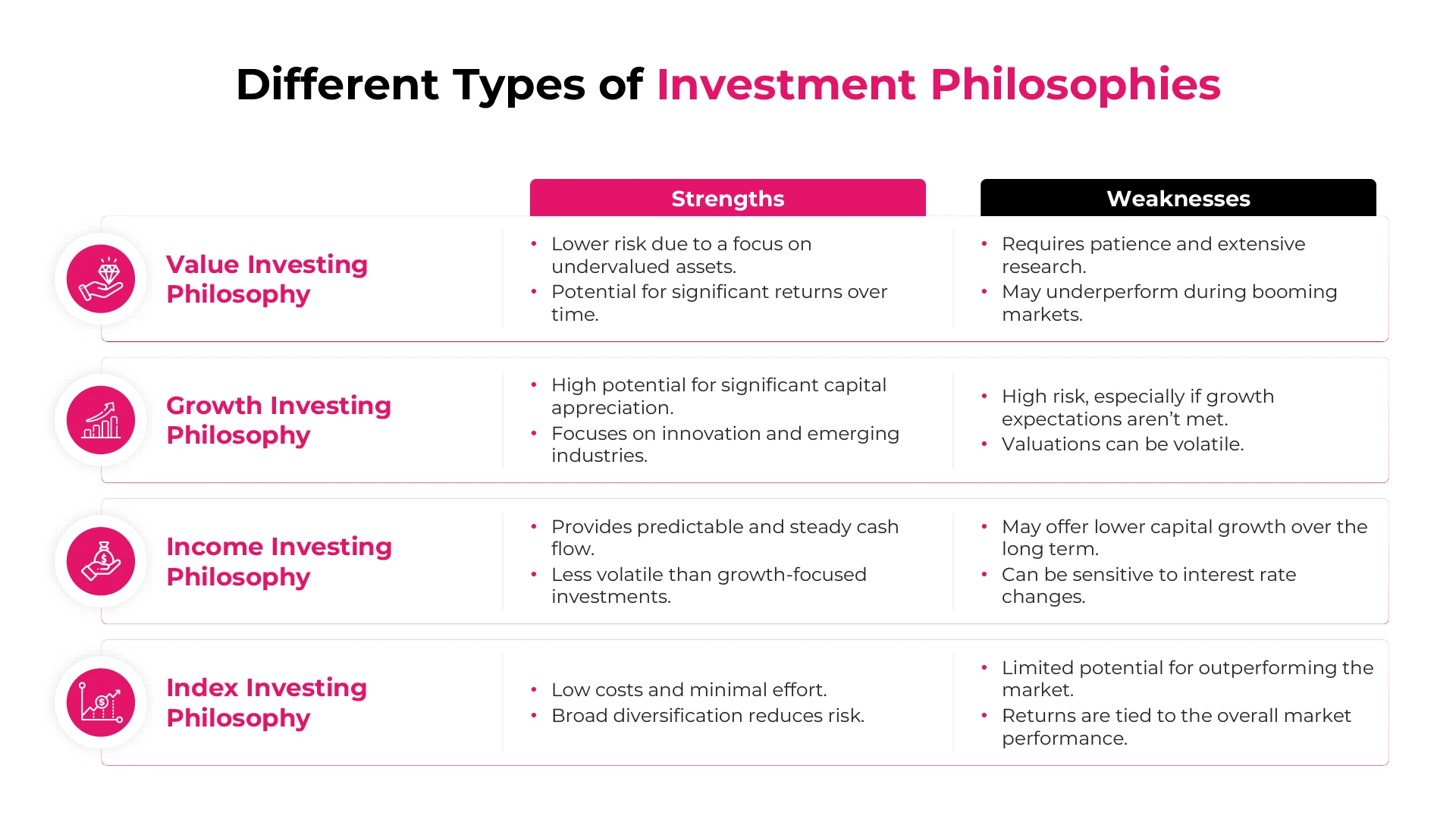

Different Types of Investment Philosophies

There’s no universal philosophy that works for everyone – different approaches suit different individuals and their unique circumstances.

Let’s understand more in detail about these most common investment philosophies:

1. Value Investing Philosophy

Value investing involves identifying and purchasing undervalued assets that have strong fundamentals. This philosophy prioritises long-term potential over short-term gains.

Example: Warren Buffett, one of the most famous proponents of value investing, has built his fortune by finding companies undervalued by the market but with solid prospects.

Strengths:

- Lower risk due to a focus on undervalued assets.

- Potential for significant returns over time.

Weaknesses:

- Requires patience and extensive research.

- May underperform during booming markets.

2. Growth Investing Philosophy

Growth investors focus on companies or sectors with high growth potential, often willing to pay a premium for promising opportunities.

Example: Early investors in Tesla embraced growth investing, believing in its potential to revolutionise the auto industry.

Strengths:

- High potential for significant capital appreciation.

- Focuses on innovation and emerging industries.

Weaknesses:

- High risk, especially if growth expectations aren’t met.

- Valuations can be volatile.

3. Income Investing Philosophy

This philosophy prioritises generating regular income, often through dividend-paying stocks, bonds, or other income-generating assets.

Example: Retirees frequently adopt this philosophy to create a stable income stream during their golden years.

Strengths:

- Provides predictable and steady cash flow.

- Less volatile than growth-focused investments.

Weaknesses:

- May offer lower capital growth over the long term.

- Can be sensitive to interest rate changes.

4. Index Investing Philosophy

Index investing is a passive approach that involves tracking a specific market index, such as the FTSE 100 or S&P 500.

Example: John Bogle, the founder of Vanguard, popularised this philosophy with the launch of low-cost index funds.

Strengths:

- Low costs and minimal effort.

- Broad diversification reduces risk.

Weaknesses:

- Limited potential for outperforming the market.

- Returns are tied to the overall market performance.

Comparison of Strengths and Weaknesses

Each philosophy has its merits and drawbacks, and no single approach is superior. The key is to understand which philosophy aligns with your values, goals, and risk tolerance. For example:

- Value investing offers stability but requires patience.

- Growth investing can deliver high returns but comes with greater volatility.

- Income investing provides regular cash flow but may lack significant capital growth.

- Index investing is simple and cost-effective but doesn’t allow for market outperformance.

Developing Your Own Investment Philosophy

Crafting a personalised investment philosophy requires reflection, research, and a willingness to adapt.

Here are the key steps to create a personalised investment philosophy:

1. Assess Your Financial Goals and Risk Tolerance

- What are your short-term and long-term financial objectives?

- Are you comfortable with high levels of risk, or do you prefer stability?

Answering these questions will help you determine what matters most in your investment journey.

2. Research Different Investment Philosophies

Educate yourself on the various philosophies. Read books, follow industry experts, and analyse the performance of different approaches. This will give you the knowledge needed to make informed decisions.

3. Test and Refine Your Philosophy Over Time

Start small by applying your chosen philosophy to a portion of your portfolio. Track your results, learn from mistakes, and make adjustments as needed.

4. Embrace Adaptability

Markets evolve, and so should your philosophy. Stay informed about trends, such as the growing emphasis on ESG investing or advancements in technology, and consider how they align with your values and goals.

The Long-Term Impact of an Investment Philosophy

An investment philosophy isn’t just about maximising returns—it’s about creating a sense of control and purpose in your financial journey. By staying true to your philosophy, you’ll be better equipped to navigate market fluctuations and achieve long-term success.

Conclusion

A well-defined investment philosophy is the foundation of financial success. It ensures that your investment decisions are intentional, aligned with your goals, and resilient in the face of market changes.

Whether you’re drawn to the stability of value investing, the excitement of growth investing, or the simplicity of index funds, the most important step is to start. At MHG Wealth, we’re here to guide you in developing a philosophy that reflects your unique needs and aspirations.

Take the first step towards a brighter financial future. Contact The Matt Haycox Group today to build your personalised investment philosophy.