A great investment strategy has insight, balance and foresight, but one of the most important aspects of getting your capital to work for you is diversification. If you’re new to investing, diversification is just a fancy way of saying don’t keep all of your eggs in one basket, because if that basket breaks, you’ll be going hungry at breakfast.

What separates a good investor from a great one is how creative they are with this diversification. Bonds, stocks and property are familiar to most people and usually find their way into an investor’s portfolio, but they don’t always generate the greatest returns.

Often, lesser known investment methods bring bigger paydays, particularly if it’s in an emerging market that is still relatively untapped.

One such alternative method is litigation funding.

What is Litigation Funding?

If you haven’t been involved in litigation yourself, you undoubtedly know someone who has.

Quite simply, litigation is the process of taking legal action. It starts with lawyers and often ends in court. Bringing a dispute to court however requires time and money, and regardless of what the dispute is, the legal playing field is rarely even, with the outcome of many cases boiling down to who can afford the best lawyer and wait it out for the longest period of time.

Indeed, it’s not uncommon to see small businesses go under when faced with a legal action (warranted or not) brought about by a larger company that financially has the upper hand.

This is where litigation funders come in.

Litigation funders

A litigation funder is a third party who provides funding to support a legal case that may not otherwise afford to seek redress. These cases can range from large class-action lawsuits to small individual claims such as personal injury or housing disrepair.

If the case wins, the litigation funder takes a share of the awarded damages, and the amounts can be huge.

In 2015 for instance, major litigation funder Burford Capital made a $16.6 million investment in litigation rights against Argentina concerning the nationalisation of the oil company YPF SA. The case ruled in favour of Burford, and a New York federal court awarded $16.1 billion in damages to the plaintiffs – $6.2 billion of which Burford reportedly stands to collect.

While the outcome still awaits the final resolution, the most recent ruling confirmed that Burford can begin going after the $16.1 billion in assets.

This is just one of the many high-stake lawsuits that has seen its way through a lengthy courtroom process with support from litigation funders (the RBS Rights Issue Litigation is a contentious recent other).

The litigation funding market is forecast to reach USD $24 billion in the next four years, presenting huge potential investment opportunities for investors seeking diversification.

Traditional litigation funding risks

Lucrative as the market is, litigation funding is not without risk.

Traditional funders essentially bet on the outcome of a legal dispute, and while legal victories can bring huge rewards, losing a case usually means a total financial loss. If Burford lost the case against Argentina for instance, it would have meant $16.6 million down the drain.

Many litigation funders spread this risk across multiple cases to mitigate losses, but it’s still far from a perfect science. In this respect, litigation funding is more akin to venture capital as a type of investment, since returns are contingent on uncertain outcomes.

So, how can you gain exposure to this emerging market whilst minimising risk and generating a steady stream of passive income?

That’s where Fenchurch Legal comes in.

Who is Fenchurch Legal?

Fenchurch Legal is a London-based specialist funder that has established a unique niche in the litigation funding market.

Like other litigation funders, the firm helps level the playing field for injured parties by providing finance to small and medium sized law firms, enabling them to take on and support more cases by freeing up cash flow.

What makes Fenchurch unique is its approach to funding.

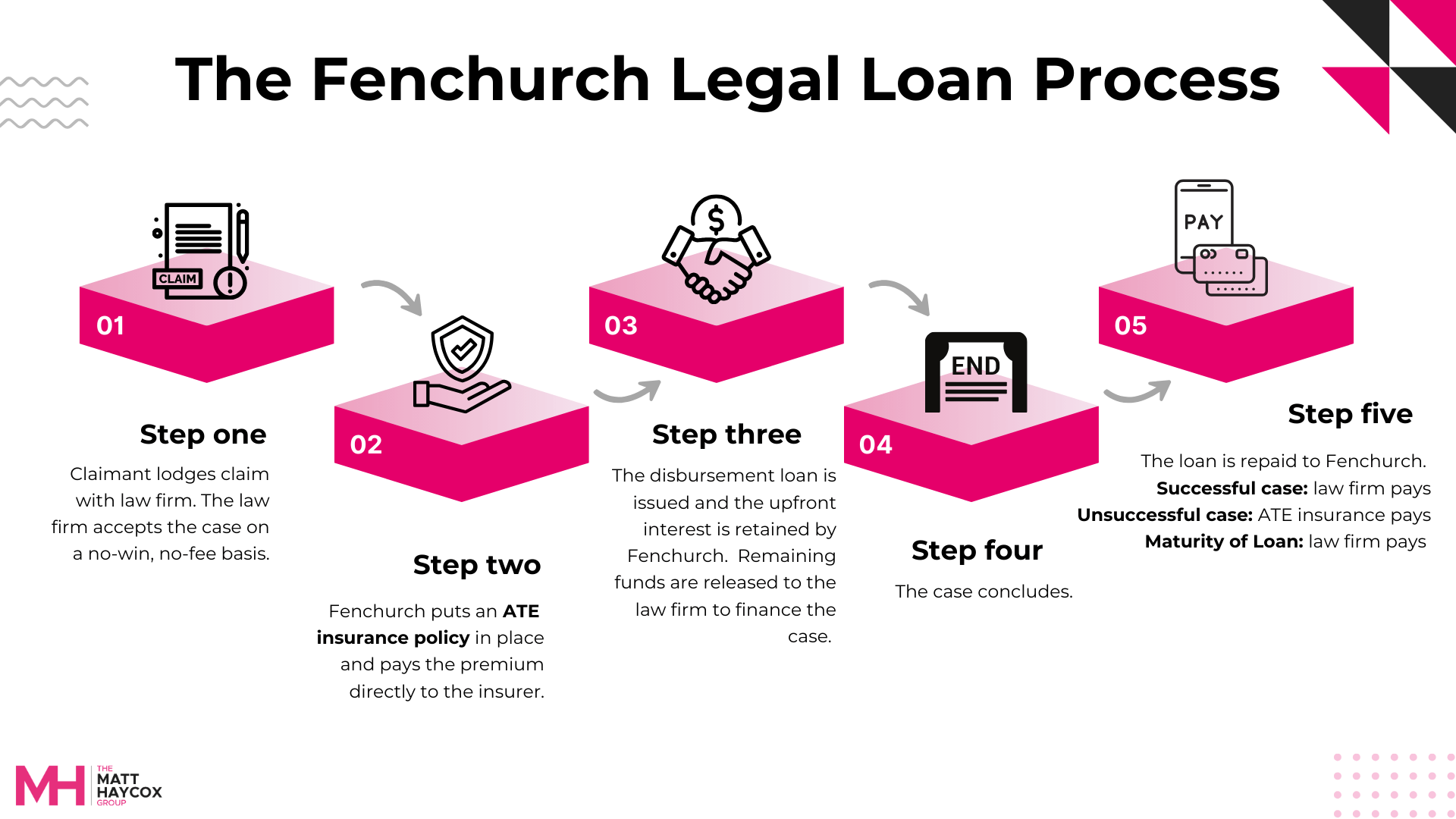

Rather than funding the lawsuit from A-Z, the firm funds disbursements, which are covered by an insurance policy that secures the debt even if the case is a loss.

What are disbursements?

A disbursement is legal speak for expenses. It is a payment made by the lawyer on behalf of their client, and typically includes things like court fees, expert witness reports, forensic accountants and the marketing fee to acquire the case in the first place.

These costs aren’t the lawyer’s time on the clock – they are payments that have to be made upfront to keep the case moving. Disbursements are typically paid by the client, but in the case of ‘no win, no fee’ legal work, the lawyer must advance the expenses with the hope of recouping the funds when the case concludes.

For large law firms with deep pockets, this isn’t an issue. But for small or medium sized law firms with limited cash flow, these costs can quickly build up and become a financial burden.

That’s why many small law firms turn to financing.

Why do Fenchurch fund disbursements?

Disbursements are a niche area of legal funding. Fenchurch specialises in this niche for two reasons.

Transparency

By only funding disbursements, Fenchurch is able to keep track of exactly where funds are being spent. This removes any ambiguity as to how the law firm borrowing the money is using the loan.

This targeted funding strategy benefits all parties: law firms gain access to the specific financial support necessary for their cases, and Fenchurch can ensure that the funds are being used exclusively to advance the success of the case.

Disbursements are insurable

The biggest risk investors face with traditional litigation funding is losing a case. Fenchurch circumvents this risk by working with specialist insurers to attach an insurance policy to each borrowed amount, ensuring that even in the event of a lost case, the insurance policy will pay out. This means that Fenchurch gets repaid in either scenario, creating a very attractive investment opportunity.

This specialist type of insurance policy is called ATE (after-the-event) insurance, and it also becomes a disbursement of each case.

What is ATE Insurance?

ATE (after-the-event) insurance is a policy that covers legal costs and expenses in the event that a case is unsuccessful. It protects claimants, law firms and investors from losses by footing the bill in the event of a lost case.

Ultimately, this ATE insurance transforms something that is high-potential but high-risk, into something that is high-potential and low-risk. This creates a much more predictable and stable business model for Fenchurch and its investors.

What case types does Fenchurch support?

Unlike other litigation funders, Fenchurch focuses on the small claims market, which is lucrative and largely untapped. Through data-driven metrics, the company identifies and vets the law firms and cases that are high-volume, low-risk and ripe with potential. This ranges from personal injury to financial mis-selling and home disrepair.

While personal injury and similar small claims lack the Harvey Spectre-style glamour of a high profile class-action lawsuit, these cases are numerous, consistent, and socially impactful. A claimant could be a tenant suffering from damp-related problems due to a negligent landlord, or a driver who has been put out of work because the car behind wasn’t paying attention.

Fenchurch covers high-volume small claims that are valued at an average of £11,000. Aside from personal injury and housing disrepair, the company covers cases involving:

- Tenancy deposits

- Plevin

- Personal Contract Payments

- Business interruption

Since 2020, Fenchurch has funded more than 10,465 cases, grossing £31.3 million in loans.

Loan Products

As discussed, many injured parties would be unable to seek redress for small claims like personal injury without having a no-win no-fee lawyer willing and able to take on their case.

To take on these cases however, lawyers and law firms must cover the client’s expenses to keep the case moving, whether it’s administration costs like couriers and photocopiers, or more expensive items like expert witnesses and court fees.

Fenchurch Legal have two loan products available for you to use.

Disbursements | WIP Loans |

A Disbursement loan covers the expenses lawyers face when working on a no-win, no-fee basis, such as, court fees, couriers, expert witnesses, and so on. It also pays for the ATE insurance policy, which repays the loan in the even of an unsuccessful case. | A Work In Progress (WIP) loan complements the disbursement loan. It provides upfront funding for a proportion of a law firm's working capital needs when cash flow is limited or stretched throughout the duration of the contingency cases. |

Features of Disbursement Loans:

| Features of WIP Loans:

|

How do Fenchurch Legal secure loans?

Charge over the legal case

As a funder with a secured interest, Fenchurch has a charge over the litigation cases it funds. If the company believes that the lawyer handling the case is not performing up to standard, they can assign the case to another lawyer to ensure that the outcome isn’t solely reliant on the original lawyer’s performance.

Assignment of the ATE insurance policy

Fenchurch cleverly uses ATE insurance to back its bets on litigation cases. In the event that there’s a pay-out from the insurance policy, Fenchurch is front of the line to get paid – assuming the relationship with the lawyer is favourable. If the company’s relationship with the lawyer is rocky, Fenchurch is able to take control of both the case and insurance policy to safeguard its own investments.

First ranking debenture

Fenchurch takes an additional step to secure its investments by obtaining a first ranking debenture over the borrowing law firm. This means that if the law firm encounters financial difficulties or fails to meet its obligations, Fenchurch has the legal right to step in and claim assets or receive payment from the firm’s holdings.

This level of security ensures that Fenchurch’s investments are protected not just by the success of individual cases, but also by the financial health and assets of the law firms themselves.

Personal guarantees

Debentures and insurance aside, Fenchurch’s position is further secured by personal guarantees from the shareholders of the law firm itself, in addition to warranties from directors. This means that if the firm cannot meet its financial commitments to Fenchurch, the shareholders will be personally liable to cover the debts.

Invest in Litigation Funding: How can investors get involved?

The litigation funding market is lucrative, but navigating the waters as an individual can be complicated – particularly for investors who already have their hands full with other commitments.

A robust infrastructure is required to identify, fund, audit, and oversee both the law firms that borrow and the individual cases they handle. Additionally, without a significant amount of capital, achieving diversification is nearly impossible.

If you would like to gain exposure to the litigation funding market without the risk and responsibility of personal case selection and management, Fenchurch’s investment product may be a good match for you.

Fenchurch have developed a simple structure for investors to gain exposure to this exciting and lucrative market while remaining completely passive. This is achieved using a loan note, which enables investors to enter with as little as £10,000.

What is a loan note?

A loan note is a debt instrument that outlines clear terms between a borrower and lender, such as loan amount, interest rate, period of lending time, and so on.

In simple terms, it’s an enforceable IOU that ensures both the borrower and lender are clear on their obligations.

Upon entering an agreement, the borrower (Fenchurch) issues its investors with a loan note outlining a fixed-income return on their investment.

To provide extra security to investors, loan notes are overseen by an independent trustee, such as a professional company or individual. This trustee is often a lawyer who is responsible for monitoring the conduct of the borrower to ensure they are carrying out their obligations as per the agreement, and in the best interests of the investors.

With the funds raised from investors, Fenchurch is able to fund a large range of small-ticket legal disputes, while investors enjoy passive exposure to the litigation funding market without the heavy lifting.

The pros of investing with Fenchurch

Diversification

In traditional litigation funding, diversification options are limited to a handful of high-value cases. These cases require a substantial investment, and the potential outcomes are very simple: it’s win big or lose big.

As we discussed earlier, if you don’t diversify your assets, things can turn south very quickly. By focusing on the high-volume small-ticket claims rather than high-profile landmark lawsuits, Fenchurch massively diversifies risk, feeding into the philosophy of win more, rather than win big.

It’s passive and stable

Investing in stocks or other tradable assets requires knowledge, responsibility and a pinch of guesswork. Whether it’s knowing when to execute a trade, when to cash-out or even how to cash-out most efficiently, it requires an active effort that is typically quite risky.

Investing in traditional litigation funders is also a gamble, because pay-outs are typically reflective of case success.

Because Fenchurch only provides loans that are ATE-insured and repaid on a continuous basis over thousands of small claims, it is able to provide investors with quarterly fixed-income payments, saving them from the headaches of trading and eagle-eyeing the market.

Unrelated to market trends

Economies are always in flux, and traditional investment markets are heavily influenced by unpredictable external factors. The best example of this might be Elon Musk’s rogue ‘funding secured’ tweet in 2018, which led Tesla investors to lose $12 billion in a matter of 10 days.

The litigation market on the other hand isn’t contingent on market trends, it’s contingent on clear-cut outcomes. When this principle is applied over thousands of small claim cases, it offers a degree of stability and predictability rarely found with other investment tools.

The cons of investing with Fenchurch Legal

Relatively illiquid

Unlike stocks or bonds that can be liquidated in a matter of moments, the capital invested in litigation funding must be committed for the duration of the case. Although investors can enjoy the stability of Fenchurch’s fixed-income pay-outs, they cannot quickly or easily liquidate their positions, should their financial circumstances change.

The market is new and evolving

Fenchurch operates in a niche legal area in a market that’s rapidly evolving. As the market continues to grow and mature, it may attract greater scrutiny from regulators who have the ability to introduce operational constraints to meet changing legal standards. While all legal or financial firms are equipped to deal with changing regulations, it can be difficult to predict exactly how changes will play out.

Conclusion

If you’re looking to get rich quickly, investing in ATE-insured disbursement funding won’t do the trick. However, if you’re looking to diversify your assets and maximise your savings beyond the interest rates offered by the bank, it may be right for you.

Litigation funders like Fenchurch offer investors stable fixed-income returns, so while the value of your assets won’t double overnight, you can expect a steady and predictable return on your investment, which can be particularly appealing in times of market volatility.

If you want to find out more about investing in litigation funds like Fenchurch, connect with one of our investment advisors, who can provide you direct guidance and insight on how to get involved in this rapidly growing asset class.