When raising capital for their business, owners often go down the route of raising equity to finance their growth plans. Equity involves selling shares in the company to a 3rd party. The company receives the capital it requires and the investors receive shares in the business which give them a share in the profits of the company and, usually, a say in the management decisions.

There are 2 main types of investors for SME businesses:

- Angel Investor: An individual investor who typically works with start-up and early stage companies.

- Venture Capital (VC) Fund: A professional investment company, which takes multiple stakes in high growth companies.

Business owners need to make the right decision when it comes to seeking and securing investment. Angel Investor or VC. Which is right for you? This is a guide to the difference between Angel Investors and Venture Capitalists, to help you choose the right funding strategy.

Who Are Angel Investors?

Angel investors are high net-worth individuals who provide capital for start-ups, in exchange for a slice of the ownership. They typically invest their own money and often take a personal interest in the success of the business, helping the founders.

Investment Stage:

Angel investors usually engage in the very early stages of a start-up’s development, often at the seed stage or even earlier, when the company may only have a prototype or a business plan. Their investments help start-ups get off the ground before they generate significant revenue.

Investment Amount:

The investment amounts from angel investors vary but are generally lower compared to venture capitalists, typically ranging from a few thousand to a million pounds. This funding is usually used to help cover initial expenses such as product development, market research, and early operations.

Involvement and Influence:

Angels often bring more than just capital to the table. Many are experienced entrepreneurs or executives who provide valuable mentorship, strategic advice, and industry connections. However, they typically have less formal control over business decisions compared to VCs.

Who Are Venture Capitalists?

Venture capitalists are professional investors who manage pooled funds from multiple sources, such as pension funds, endowments, and wealthy individuals. These funds are allocated to start-ups with high growth potential, typically in exchange for equity.

Investment Stage:

VCs usually enter the picture at later stages compared to angel investors, such as Series A funding and beyond, when the startup has achieved some level of product-market fit and demonstrates growth potential. They seek companies poised for significant scale.

Investment Amount:

Venture capital investments are substantially larger than those of angel investors, typically from hundreds of thousands to the multi-millions. These funds are used for scaling operations, expanding market reach, and further product development.

Involvement and Influence:

Venture capitalists typically demand a more significant degree of control and influence over the companies they invest in. This often includes board seats, voting rights, and strategic input. Their involvement is more hands-on, focusing on scaling the business, professionalising operations, and sharing their expertise.

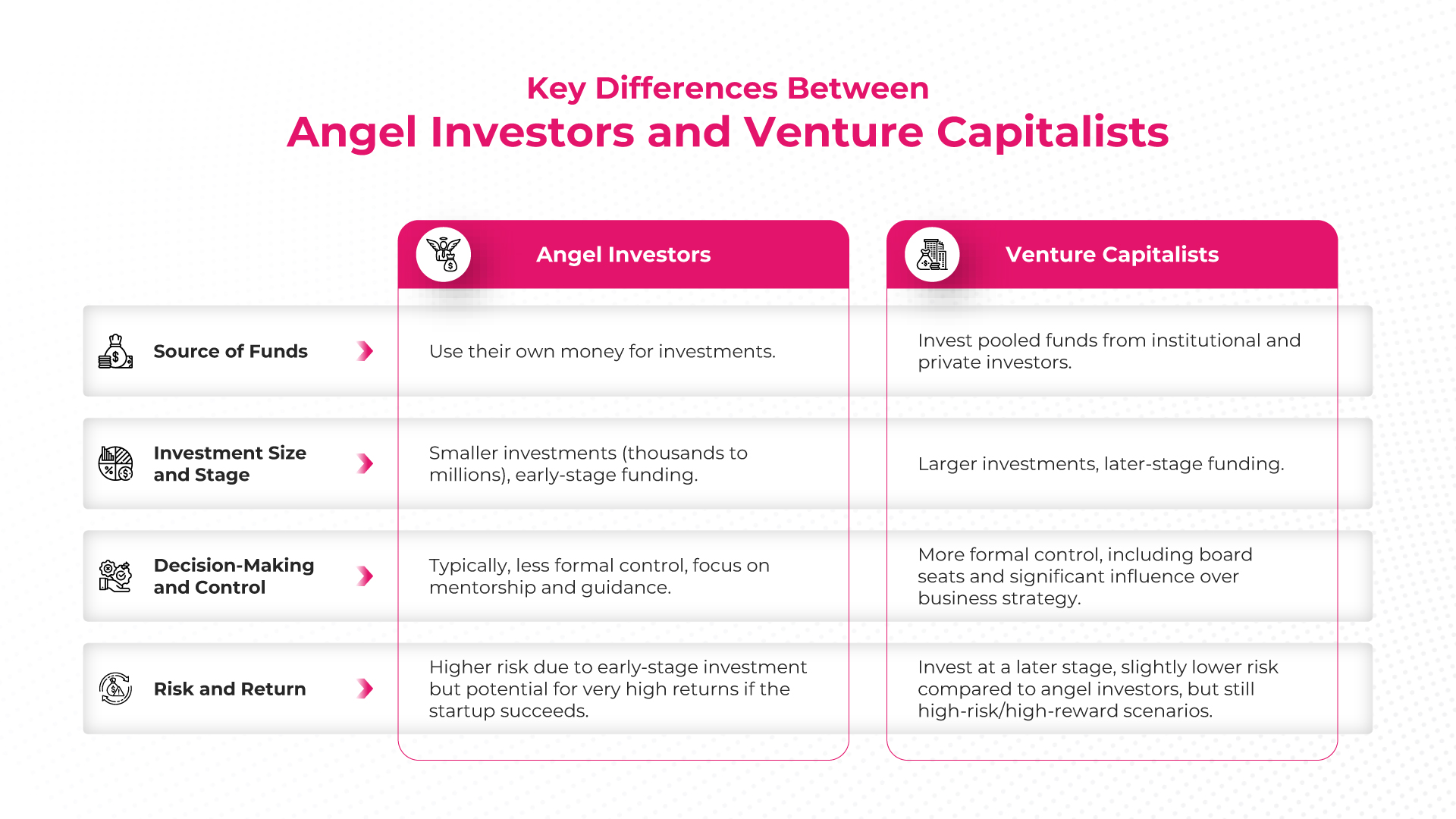

| Angel Investor | Venture Capitalist | |

| Source of funds | Use their own money for investments | Invest pooled funds from institutional and private investors |

| Investment size and stage | Smaller investments (thousands to millions), early-stage funding | Larger investments, later-stage funding |

| Decision-making and control | Typically less formal control, focus on mentorship and guidance | More formal control, including board seats and significant influence over business strategy |

| Risk and return | Higher risk due to early-stage investment but potential for very high returns if the start-up succeeds | Invest at a later stage, slightly lower risk compared to angel investors, but still high-risk/high-reward scenarios |

Angel Investor vs Venture Capitalist: Which is right for your business?

Angel Investors are individuals who enjoy supporting start-ups. Introductions are typically done at pitching and networking events. Some of the most active angel investment organisations in the UK are Oxford Innovation Finance, Central Arc Angels for the Midlands, Angels@Essex, Angel Capital Scotland, Angels Invest Wales, Minerva Business Angel Network, Cambridge Angels, and South West Angel and Investor Network.

The best place to start searching for an investor is the UK Business Angels Association, which lists events, and hosts useful materials for founders. More than 70 events are hosted nationally, with around £2.3bn invested annually from more than 650 angel investors.

Angel Investors are smaller scale than VCs, and they bring a personal touch. Your Angel will do their own research, and make the investment decision on their own. There are downsides: Angels usually lack the support network offered by a VC fund. For example, Angel Investors tend to oversee their own legal work.

If your business has high growth potential, it may be preferable to approach a VC. There is the chance to return for further funding rounds, a more formal relationship, and VCs may be able to offer professional consulting services to founders. University spin-outs, management buy-outs, and start-up’s with a strong intellectual property portfolio have a natural Venture Capital bias for these reasons.

VCs may be more demanding, in terms of growth and accountability. They often introduce milestones for the companies they invest in. These are targets which the founders are expected to hit. It has been known for a founder to be removed for failing to hit milestones.

How long do you plan to grow your business before you make a profit? Angels are shorter term than VCs. If you aren’t making money within two or three years, most Angels will begin to lose patience, unless you have a strategy they understand and agree on.

Venture Capital funds run to a ten-year horizon, typically. Profits are then returned to the investors at the end. VCs tend to offer a greater range of exits: floating on the stock exchange or sale to another VC house is possible. Angels rarely have the financial firepower to navigate a float, and sales tend to be a trade buyer, rather than investment fund.

How to pick the right VC

If you have decided that the VC route is right for you, then you need to make sure you are getting into bed with the right financial partner. The right partnership comes down to two things: the deal, and the personality of the investors. Equity investment requires a close bond between the founder and their key investors, so it is important their ethos, personalities, and aims are aligned.

Conclusion

Angel Investors and Venture Capitalists play crucial roles in the start-up ecosystem. Each has their own distinct characteristics, investment strategies, and involvement levels.

An Angel Investors is suited to businesses seeking smaller amounts, arranged in a more informal manner. Venture Capital is the better choice for companies looking for a more structured approach, and the opportunity to work alongside experienced teams.

The Matt Haycox Group is the perfect hybrid between an angel investor and a venture capital fund.

We are small enough to work incredibly closely with our portfolio companies, but big enough to have the financial firepower to support our investee companies with all of their funding requirements.

If you would like to learn more about partnering with The Matt Haycox Group for your growth and venture capital needs then speak to one of our investment specialists today.